Table of Contents

- iShares Core S&P 500 ETF Prospectus

- IVV Bombay Individual Bowl Tobacco Decoration - Artelia

- IVV ETF Stock Review | S&P 500 ETF (ETF Investing Australia) - YouTube

- iShares Core S&P 500 ETF (IVV) - WeInvests

- Ishares Core S P 500 Etf Chart - Ponasa

- Here's why the iShares S&P 500 ETF (IVV) flew 6% higher in October

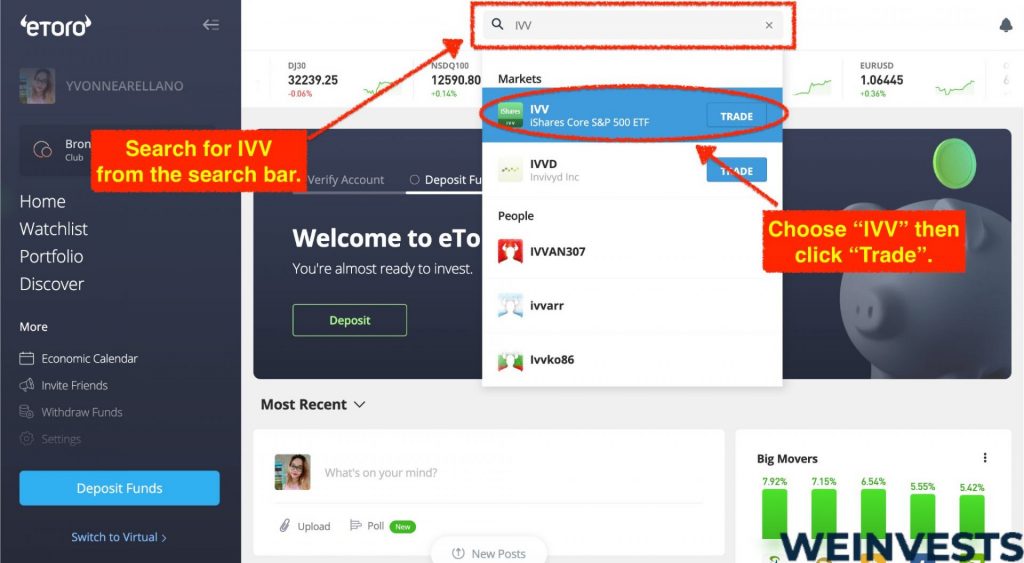

- How to Buy iShares Core S&P 500 ETF (IVV) on eToro? | CoinCodex

- IVV Diamante Rectangular Tray - Clear - Artelia

- IVV ETF - 미국 S&P500 ETF : 네이버 블로그

- 3 strengths of the iShares S&P 500 ETF (ASX:IVV)

Introduction to IVV ETF

IVV ETF Stock Price Analysis

Key Features and Benefits of IVV ETF

- Diversification: By tracking the S&P 500 Index, IVV offers exposure to a broad range of sectors and industries, reducing reliance on the performance of individual stocks. - Low Costs: IVV is known for its competitive expense ratio, making it a cost-effective option for investors seeking to minimize fees. - Liquidity: As one of the most popular ETFs, IVV has high trading volumes, ensuring that investors can easily buy and sell shares. - Transparency: The holdings of IVV are transparent and publicly available, allowing investors to see exactly what they own. The iShares Core S&P 500 ETF (IVV) stands out as a premier choice for investors looking to tap into the U.S. stock market. With its diversified portfolio, low costs, and high liquidity, IVV offers a compelling investment opportunity. For those interested in tracking the IVV ETF stock price, numerous financial websites and platforms provide real-time data and analysis tools. Whether you are a seasoned investor or just starting to build your portfolio, understanding the IVV ETF can be a crucial step in achieving your long-term financial goals. Always remember to stay informed, diversify your investments, and consider seeking professional advice to navigate the dynamic world of ETFs and beyond.Disclaimer: The information provided in this article is for educational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.