Table of Contents

- Fica And Medicare Withholding Rates For 2024 Withholding - Nani Tamara

- Social Security 2024: +0/MO, TAX ELIMINATION + MORE (SSI SSDI SS VA ...

- 2024 Social Security & the Massive Changes Coming... SSA, SSDI, SSI ...

- Social Security RAISES & TAXES! Here’s What Congress Just Said - SSI ...

- 2 States Stopped Taxing Social Security in 2024 (But 10 States Still Do)

- YOUR Taxes in 2024 - Will YOUR Social Security Be Taxed? - YouTube

- 5.2% Increase to Social Security Maximum Taxable Earnings in 2024 - YouTube

- How Much Is Social Security Withholding 2024 - Codee Devonna

- 0 Increase for Social Security in January 2024 – Who is Eligible for ...

- HUGE CHANGES! Social Security INCREASE by Double Tax Elimination - SSI ...

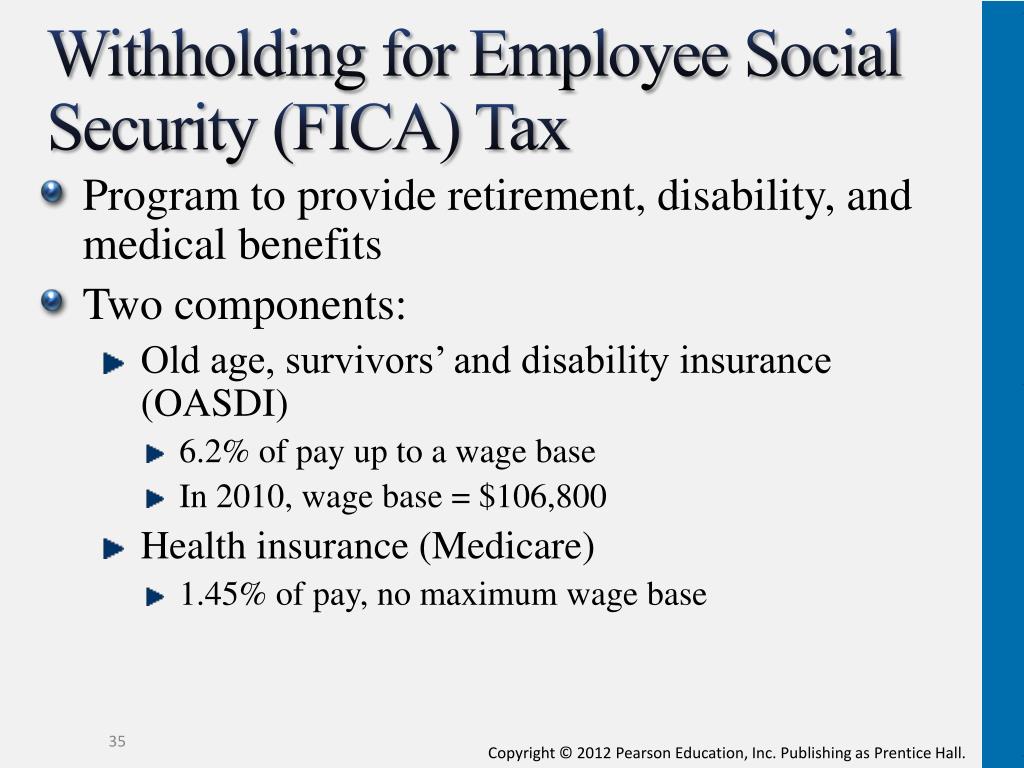

Current Social Security Tax Rates

The Social Security tax rate has remained steady at 12.4% since 1990, but the taxable maximum has increased over the years to account for inflation and rising wages. Despite this, the Social Security trust funds are still facing a significant shortfall, with the latest projections indicating that the funds will be depleted by 2035.

The Tax Rate Ceiling: How High Can It Go?

Some experts have suggested that a modest increase in the tax rate, such as an additional 1-2% on earnings above the taxable maximum, could help extend the solvency of the trust funds. Others have proposed more drastic measures, such as removing the taxable maximum altogether, which would require high-income earners to pay Social Security taxes on all their earnings.

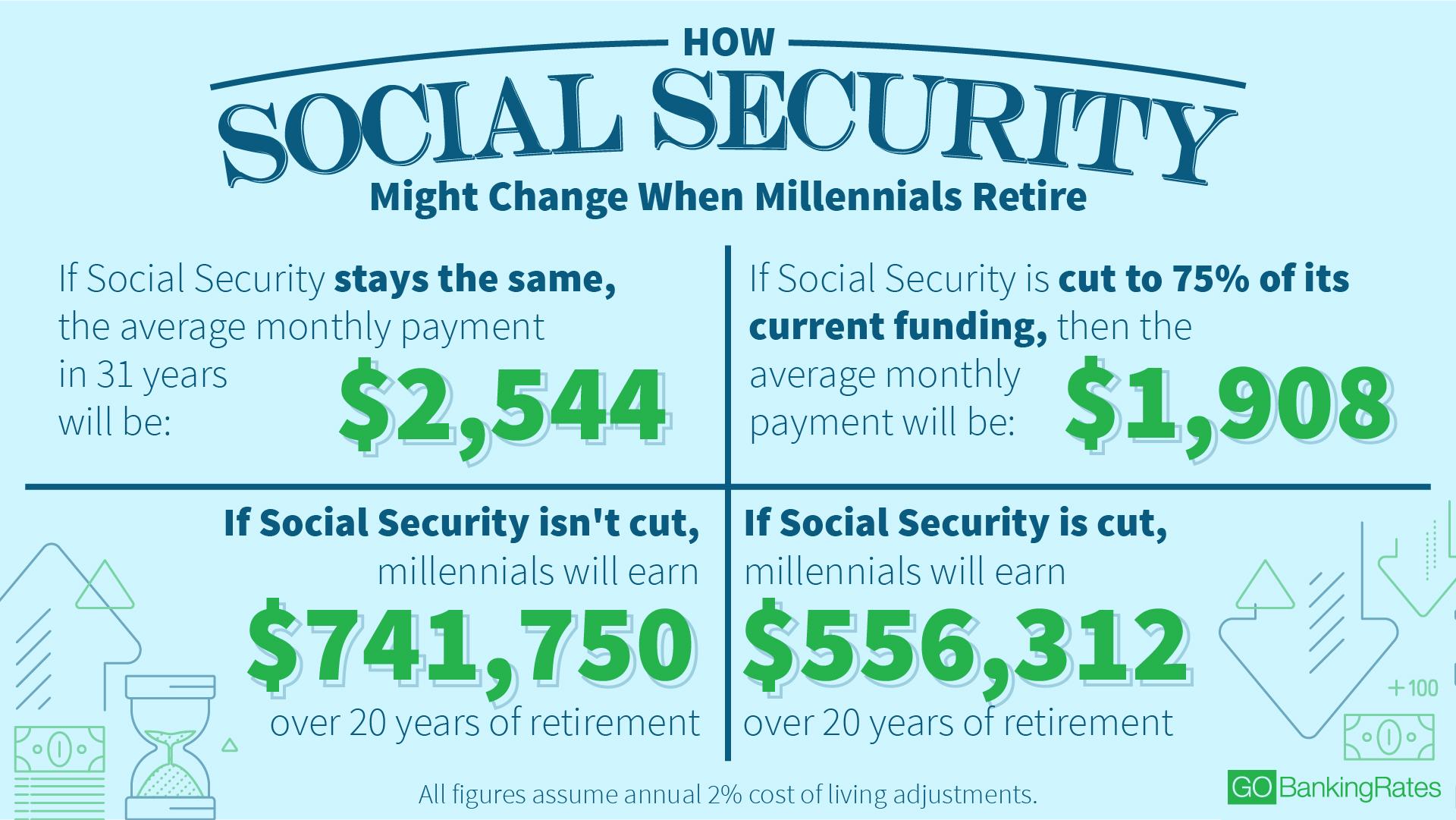

Future Projections: What to Expect

Looking ahead, it's likely that Social Security taxes will increase in some form, although the exact nature and extent of these increases are uncertain. The 2022 Social Security Trustees Report projects that the trust funds will be depleted by 2035, at which point the program will only be able to pay out about 80% of scheduled benefits.To avoid this shortfall, lawmakers may consider a combination of tax increases, benefit reductions, and other reforms. Some possible scenarios include:

- Increasing the Social Security tax rate by 1-2% on earnings above the taxable maximum

- Removing the taxable maximum and requiring high-income earners to pay Social Security taxes on all their earnings

- Implementing means-testing for Social Security benefits, where higher-income beneficiaries receive reduced or no benefits

- Raising the full retirement age for Social Security benefits

Stay tuned for further updates on Social Security tax rates and other important developments affecting your financial future.